Digital Marketing Strategies for Insurance Companies to Make a Difference

A consumer’s insurance journey begins with a Google search for “insurance near me.” An insurance marketing strategy that brings its company into the top 5 Google results bags the consumer.

Why would the consumer go beyond the top search results anyway?

In fact, mobile queries that contain “insurance near me” have grown by over 100% in the past two years. This is why optimizing your website is one of the top insurance marketing strategies, just to be discovered by your consumers.

However, many more ways exist, including email marketing, social media marketing, enhancing the customer experience with interactive designs, etc. Plus, the insurance industry also demands educating its consumers, birthing the need for content marketing.

Through this blog, we’ll look at five digital marketing strategies for you to make a difference.

Before that, shall we quickly understand the importance of digital marketing in the insurance sector? Because there are chances, as slim as they are, that you may not even be on board with going digital yet!

The Role of Digital Marketing in the Insurance Industry

We have already given you a solid first reason to go digital, with a stat mentioning people who turn to Google to find the best insurance companies near them. However, if you still have reservations about leveraging digital marketing, we’ve listed four more reasons, well, questions.

How else do you acquire customers?

Since 5.30 billion people across the globe are on the web, you must leverage digital marketing to reach a wider audience. Here’s when channels such as search engines, social media, and advertising come in handy.

How do you make your brand more visible, if not through digital marketing?

Establishing a brand identity isn’t solely about reaching your customers. It’s also equally important for your potential customers to contact you. SEO and social media marketing enhance brand visibility, which makes it easy for customers to reach out.

How do you keep your customers engaged?

Reaching out to customers is only possible with social media platforms and email marketing. Updates, new app features, or educational content help build trust and long-term customer relationships.

How do you leverage targeted advertising?

Targeted advertising is one of the greatest boons of the internet and customer data. By decoding consumer behavior, you can run targeted ads and attract users who are genuinely interested in your policies.

Keep your business off the internet unless you have alternative answers to these questions. If not, it’s high time to get on the web!

Now that we know how vital it is for insurance companies to leverage digital marketing, let’s go deeper into five strategies.

4 Digital Marketing Strategies for Insurance Companies

From the design of a website to the content across social media to whether the website content gets updated or not, digital marketing is multi-faceted. There’s no one-size-fits-all approach here. Hence, we’ll take a look at all these facets one by one.

1.Optimize Your Website to Be Google-Searchable

An effective SEO strategy gets your website in front of users’ eyes.

Now, you could achieve this by:

- Creating relevant content for your website and social media

- Designing an easy-to-navigate website

- Using keywords in content

Let’s see an example.

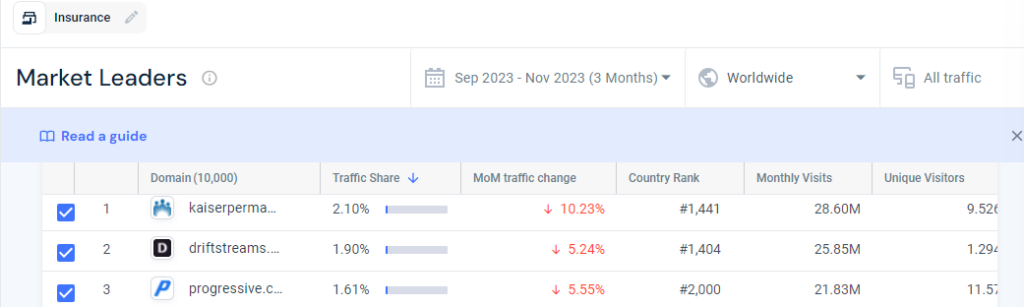

When we Googled “top insurance website ranking in November 2023” we got a list of hundreds of companies, of which the top three are in the snapshot below.

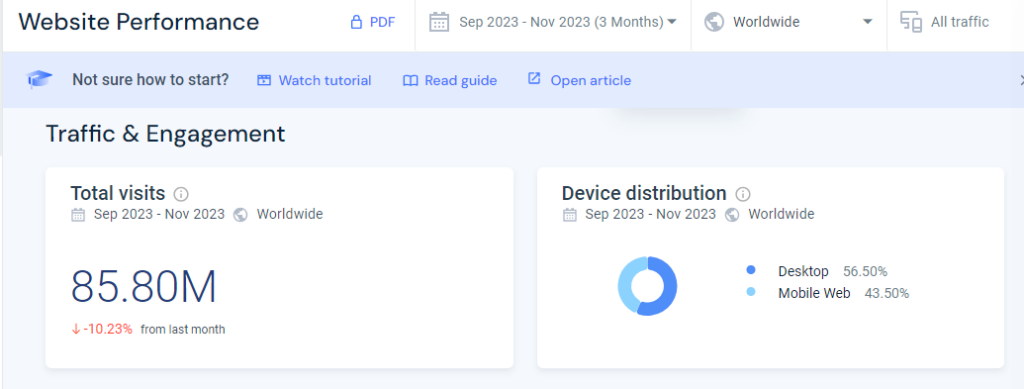

Of the three, the first website, Kaiser Permanente, a US-based health care plan provider, has 85.80M visits from September 2023 to November 2023.

One of the biggest reasons it ranks well on Google is that it provides end-to-end care to its customers. For example, its website has features ranging from finding a doctor to locating services to finding the perfect healthcare plan for you or your family. Moreover, it has broker resources and employer resources distinguished.

What stands out?

- Although it offers healthcare plans, it has positioned itself as a healthcare provider. (Strong brand positioning, tick.)

- The website offers numerous resources for a single topic. (Valuable content, tick.)

- The website is easy to navigate (easy navigation, tick)

- The content hierarchy is solid, making it easy for users to navigate. (Solid content hierarchy, tick.)

If you want to create an SEO-friendly website, ensure your website offers valuable content, is easy to navigate, caters to all target user categories, and follows a content pillar for users to navigate easily!

2.Leverage Email Marketing Automation

You’ll get ample resources for generating leads with email marketing. However, its role is way more than that. From generating and converting leads to strengthening relationships with existing customers, email marketing is a perfect insurance digital marketing strategy to attract customers from the top, middle, or bottom of the sales funnel.

However, getting customer information and sending personalized emails takes a lot of work. Take a step further by automating email marketing. Personalize the emails and add a subscriber’s name to email them automatically.

Create Custom Email Campaigns

For example, if your company offers home and health insurance, you can create custom campaigns and audience segments depending on each subscriber’s interest. Doing so will personalize subscribers’ experiences, making your email content more meaningful.

As an insurance agent, you could leverage email marketing automation to send emails on the following subjects.

Thank You or Welcome Emails

For Thank you emails, keep them short and sweet. For example, appreciate them taking the time to fill out a feedback form or purchase an insurance plan from you. In case of welcome emails, keep the tone warm and welcoming throughout and let them know how you’ll be their partner in this journey.

Share Non-Salesy Emails

Share your brand values, experiences, customer reviews, or lifestyle topics like fitness, travel, health, etc., to educate your readers.

Policy Renewal Reminder Updates

Send reminders before and during the policy renewal period so that it reaches the right people at the right time. Also include the policy details to be renewed, including the policy name, the amount insured, and the benefits of renewing them.

Whether you want to devise a digital marketing strategy for insurance companies or a marketing strategy for insurance brokers, investing in email marketing is a must. You may not automate them right away, but ensure you leverage email marketing without it before you get a high subscriber volume.

3.Use Content Marketing to Educate Users

While publishing long-educative website posts is one way to be searchable online, leveraging social media marketing is another smart move. From posting case studies to generic tips and advice when purchasing an insurance coverage plan, you could use social media as your company needs it.

Post Reviews or Testimonials

For example, if we take a look at State Farm, one of the largest insurance providers in the US social presence, we see that they publish everything from testimonials to advice.

Include Content Related to Social Responsibility

Did you know that 76% of companies report on CSR as a way to reduce brand reputation risk? Regardless of the business sector your company falls under, the best marketing strategies for insurance agents incorporate CSR activities in some way, as it helps build authority and connect with users.

For example, State Farm posted a video showcasing safety guidelines to avoid animal collisions on the road.

Include Festive Content

The easiest way to generate content online is to connect festivities with your digital marketing goals. For example, the post below highlights a few holiday tips to keep in mind this Christmas!

4.Monitor and Measure your Digital Marketing Strategies

Aimlessly shooting your shots will only give you random flukes. For consistent monitoring of digital marketing strategy for insurance companies, you need to,

Clearly Define Your Business Objectives

- What business goals do you want to achieve through digital marketing (for example, I want to double my reach in the next three months or increase my engagement rates on Instagram by at least 10% in the next two months, etc.)

- How do you align your overall insurance goals with digital marketing goals?

- How do you translate these objectives into measurable indicators? (also known as KPIs)

Key Metrics and KPIs for Insurance Marketing

Quote rate: the speed at which insurers generate policy quotes after customers submit their information

Bind rate: the time required to bind a policy after collecting customer data

Conversion rate: the number of customers who purchase an insurance coverage package

Customer satisfaction: customers’ sentiments toward the policy submission

There are many other KPIs, including customer retention rate, acquisition costs, policy renewal rates, etc. It’s up to you to decide how much to narrow down.

Ways to Measure KPIs

- Most analytics software and reporting tools help with monitoring and analyzing customer-related KPIs.

- Risk management tools help insurers identify and mitigate risks.

- Claims management systems help optimize the claims process, contributing to claims processing and customer satisfaction KPIs.

- CRM (Customer Relationship Management) systems help with KPIs related to marketing and sales.

Depending on your business requirements, choose the tool that best fits your needs.

In Conclusion

The digital marketing strategies mentioned here will help you create your own. However, reach out to the top digital marketing agencies for fintech companies for a more professional touch. After all, strong experience goes a long way when you want to stand out in such a competitive sector.

So, which of the strategies have you already implemented? If not, are you ready to implement any?