The 2023 Agency Valuations Report

During 2022, Productive developed a questionnaire with one goal in mind – to better understand agency mergers and acquisition trends. Whether you’re trying to sell your agency or are just curious about the value you’ve created, understanding factors that impact your agency’s value is a crucial part of steady growth.

From January to June 2023, Productive managed to gather responses from 796 agency businesses on questions related to agency valuations. The data was gathered from a wide range of agencies, from more than 60 countries through the Agency Valuation Calculator.

The gathered data was analyzed and consolidated into the 2023 Agency Valuations Report with the aim of providing insights to agency professionals that are based on recent data.

Keep on reading to get the latest scoop on agency valuation trends.

The Basics: Size, Agency Revenue, EBITDA and Growth

Agency size might not seem like the most obvious metric you should keep track of, but oftentimes it correlates with revenue, meaning that bigger agencies usually bring in more money.

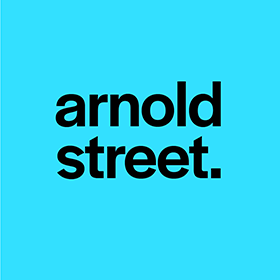

When looking at the size, agencies were divided into four categories:

Source: Productive.io

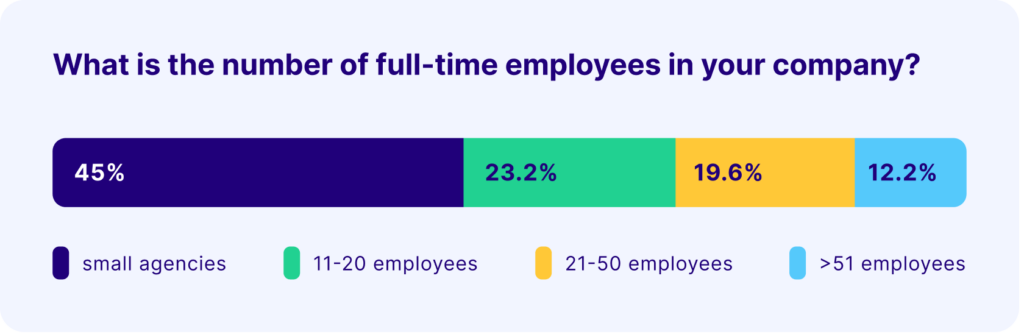

When speaking about agency revenue, respondents were divided into 2 categories: above and below $1M USD in revenue. This revenue category, combined with EBITDA, determined the multiplier used to value your agency. This means that the more you earn the higher the multiplier and, in the end, the higher the valuation.

The findings were as follows:

Source: Productive.io

In terms of average annual revenue growth, in a 2 year period from 2020 to 2022, around 22% of the companies grew below 10% a year while almost half of the agencies said that their average yearly growth was over 30% for the same time period.

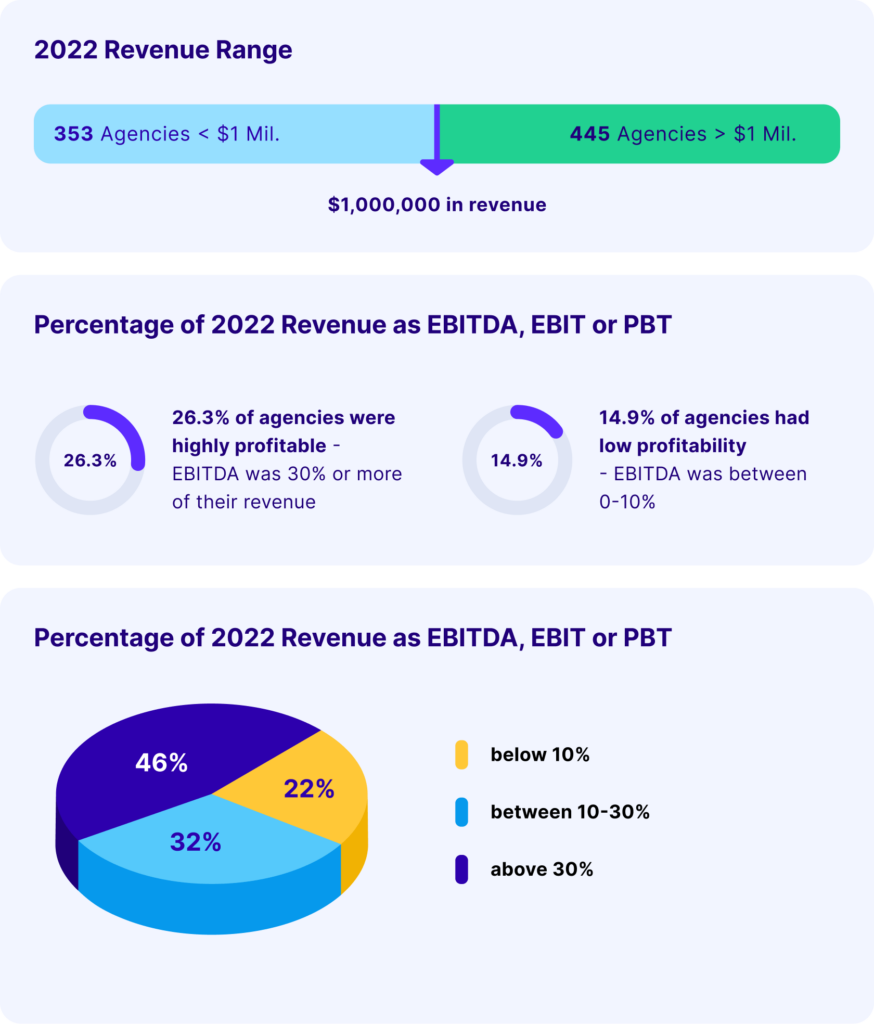

Client concentration is another key aspect of your agency’s value. It shows the percentage of yearly revenue brought in by your largest client.

You’re probably thinking: “Why would this be important?” and it’s understandable. At first, it doesn’t seem like something all too important, but it shows how much risk your business might be carrying. If your biggest client churns, how much of your yearly revenue will be lost? It’s generally agreed upon that when looking at client concentration, anything below 25% is favorable.

Around 26.3% of the surveyed companies reported that more than 30% of their yearly revenue comes from their largest client.

Source: Productive.io

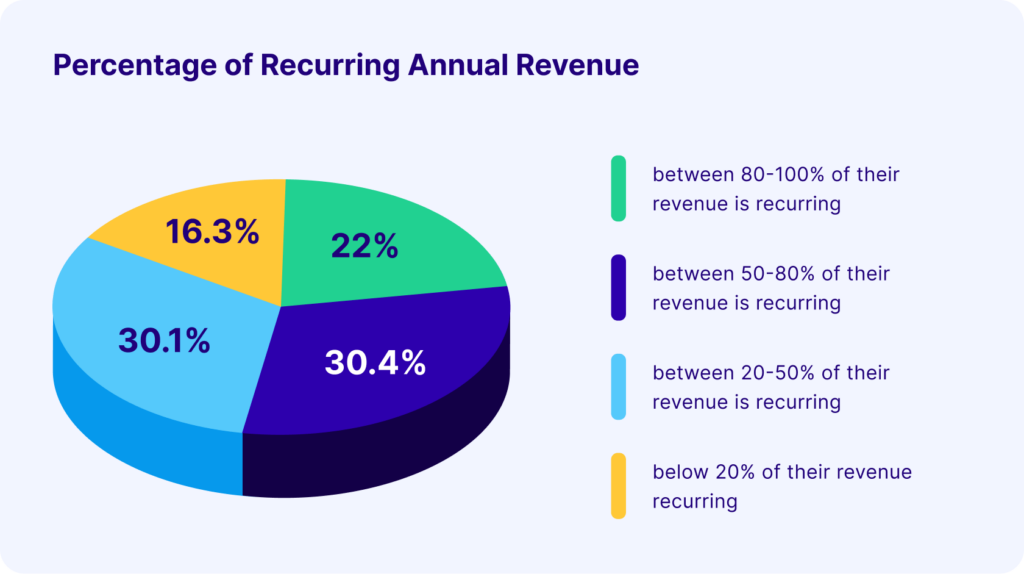

In terms of revenue, it’s also important to know how much of an agency’s revenue is recurring. Knowing your recurring revenue is valuable because it provides investors with a certain level of safety in regard to the business they’re acquiring. More than half of the agencies participating in the survey reported that 50% or more of their revenue is recurring.

Source: Productive.io

Business Development and Management Robustness

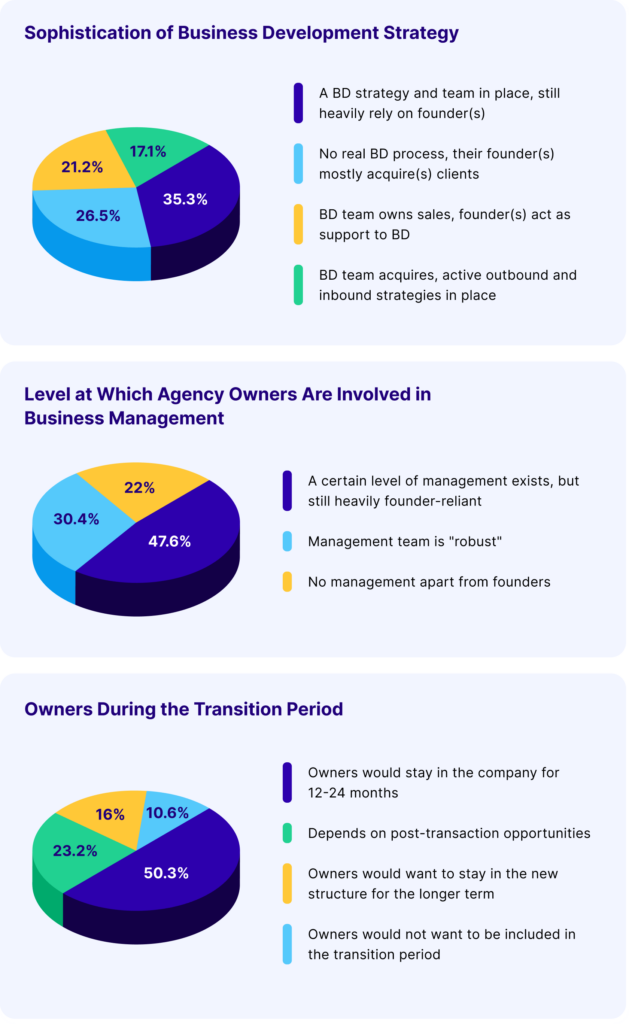

Buyers value well-established processes and documented workflows. It shows that your agency has structured operations. Having a business development strategy in place is also recommended, it helps buyers see how your agency will operate once it’s sold.

Most of the businesses reported that they had a business development strategy in place, but the founders were still involved to some extent. Around 80% of the respondents said that they have some level of management in place but their founders are still involved in management.

Source: Productive.io

Another thing that contributes to the perceived stability of your agency is the willingness of management to be involved in the future work of the agency after it’s sold. The findings show that most agency owners plan on staying with the company for anywhere between 12 and 24 months.

Data Consolidation and Business Operation Tools

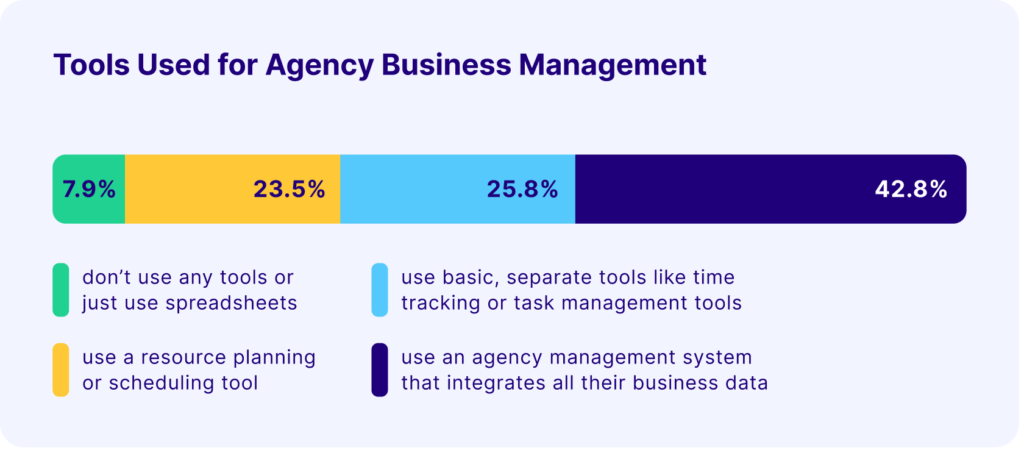

One of the most interesting findings of the study is that on average, less than half of the agencies use an integrated platform that consolidates all of their business data.

Source: Productive.io

Effective agency management relies on the strategic consolidation of business data. Harnessing this data allows agencies to streamline operations, allocate resources efficiently, and make precise forecasts for future trends.

To enhance agency valuations and maximize opportunities for mergers and acquisitions, undertaking this pivotal step is imperative. Explore the comprehensive agency business management capabilities of Productive for a seamless end-to-end solution.

The Dos and Don’ts

To help you quickly assess whether you might be making some of the most common mistakes, take a look at the list of do’s and don’ts.

Source: Productive.io

Overview: What the Agencies With the Best Valuations Are Doing

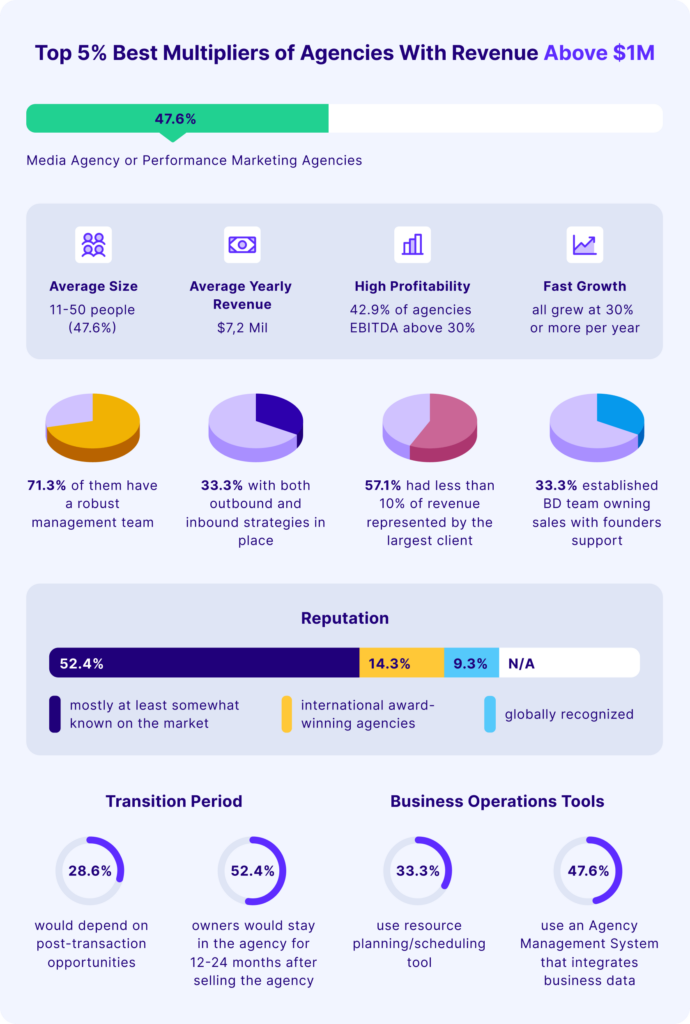

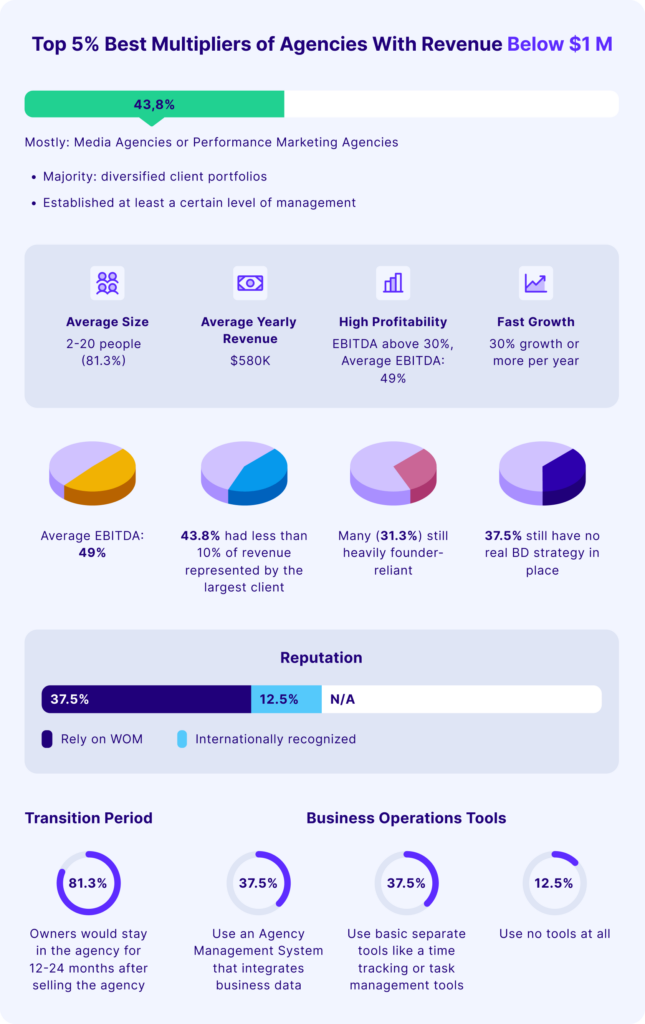

You might be interested in seeing how you fare against the top agencies. Below you can find a performance sheet for the top 5% of agencies with the highest valuations for both revenue categories: revenue below $1M and revenue above $1M.

Source: Productive.io

Several evident distinctions exist between the leading agencies in the over $1M revenue category and those in the under $1M revenue category. While both groups demonstrate elevated profitability and swift growth, the top agencies with revenue below $1M rely more heavily on founders for business development, as many lack a formal sales strategy. Additionally, they tend to utilize a variety of disparate tools that do not consolidate their business data into a unified platform.

Source: Productive.io

Takeaway

In the dynamic landscape of agency valuations, a few key moves can significantly impact your agency’s worth. First off, prioritize steady growth by diversifying your client base and aiming for a consistent revenue increase, preferably over 30% annually. This not only improves day-to-day operations but significantly boosts your agency’s market value.

Next, consider risk management by maintaining a diversified client base—keeping client concentration below 25% is a good rule of thumb. Ensure that at least half of your agency’s revenue is recurring, offering a stable income stream that appeals to potential investors.

Operational efficiency is crucial. Develop well-documented processes and workflows, showcasing a structured operation that appeals to buyers. Embrace integrated platforms for data consolidation to streamline operations, allocate resources efficiently, and make precise forecasts.

Lastly, plan for the future. Even after a sale, your involvement matters. Most successful agencies have their founders staying with the company for 12 to 24 months post-sale, contributing to the perceived stability of the business.

In essence, the key is a strategic approach that combines consistent growth, risk mitigation, operational efficiency, and thoughtful planning for the future, all of which contribute significantly to elevating your agency’s market value.

Get an Estimate of Your Agency’s Value With the Agency Valuation Calculator

Whether you’re contemplating a sale or simply curious, understanding your agency’s value is crucial for building long-term benefits. Ensuring stable revenue streams, cultivating a diverse client base, establishing a strong management structure, and leveraging integrated data are essential elements. These factors not only improve day-to-day operations but also substantially increase the market value of an agency.

Try the Agency Valuation Calculator to learn what influences the total value of your agency, plus how you can increase it.