The Supplement Ad Report 2025: What Actually Works in Meta Advertising Now

The world of supplement advertising has never been more competitive or more data-rich.

At Evolut, we work exclusively with supplement and beauty brands to drive performance through standout creative, strategy, and full-funnel execution. This year, we dove deep into a dataset of 500 Meta ads from 50 global supplement brands to uncover what truly moves the needle in 2025.

This isn’t another surface-level trend piece. We used advanced statistical modeling, including Cox regression, Kaplan–Meier survival analysis, and Pearson’s Chi-squared tests to explore which formats, creatives, and landing page styles correlate with longer ad lifespan, a strong proxy for performance, profitability, and scalability.

Here’s what we uncovered.

1. Ad Longevity Matters More Than Ever

Not all ads are created equal and some run far longer than others.

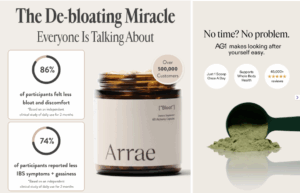

In our analysis, the average Meta ad duration across 500 creatives was 256 days, but some standout campaigns ran for 600+ days without interruption. We used AG1’s ads as a benchmark for comparison and found that some brands, like Arrae ran ads that were 67% less likely to terminate on any given day compared to AG1.

By contrast, others like ATP Science showed a 34x higher risk of ad termination, indicating issues with creative fatigue, performance decay, or misalignment with Meta’s quality signals.

Longevity isn’t just about creative quality. It’s a reflection of how well a brand aligns messaging, targeting, and conversion strategy and whether the ad can stand the test of paid traffic at scale.

2. Single Image Ads Are the Unexpected Winner

We expected UGC to dominate. But in 2025, it’s the humble single image ad that outperformed all other formats.

- Single image ads had the highest average ad duration at 268 days.

- They outperformed video, UGC, and animation, despite being simpler and often overlooked.

The takeaway? Don’t overcomplicate it. For many supplement brands, clear visuals paired with strong product messaging still work, especially at the top of the funnel.

3. Product Demonstrations Outperform Lifestyle Shots

When it comes to creative type, demonstration ads (those showing how the product works or is used) made up the largest share at 42% of all ads analyzed.

And they weren’t just common, they were effective.

Demonstration-focused videos had longer-than-average campaign durations and were most frequently used by high-performing brands like Moon Juice and JSHealth. In contrast, lifestyle-only ads underperformed unless combined with educational or product-driven content.

4. Value and CTA-Driven Messaging Beat Social Proof

Social proof is often considered a must-have, but our data says otherwise.

- Ads using social proof language (“bestselling”, “award-winning”) actually performed 3.8% worse in ad longevity than ads emphasizing clear product benefits or functional ingredients (like “collagen” or “probiotic”).

- CTA-heavy creatives and value messaging (e.g., “Here’s what you’ll get…”) drove longer performance and higher stickiness.

5. Quizzes Are Severely Underused, But Highly Effective

Only 6.6% of ads in our sample linked to a quiz-style funnel, but these pages performed remarkably well.

Why? Because they connect cold traffic with a personalized buying journey. A well-crafted quiz doesn’t just educate, it qualifies, segments, and builds trust.

Brands leveraging quiz funnels created longer ad durations and smoother conversion flows. This is a huge opportunity in an industry where differentiation is tough, and personalization matters.

6. Product Pages Still Dominate, But Strategy Matters

56.8% of ads in our study led directly to a product page. It’s the standard, but not always the most effective.

What separated high-performers wasn’t just the destination, but how clean, conversion-optimized, and mobile-first those product pages were.

Brands like AG1, JSHealth, and Moon Juice used stripped-down pages with minimal friction, fewer distractions, and direct calls to action, contributing to longer campaign runs and lower drop-off.

7. UGC Is Still Undervalued by Long-Running Brands

Despite being widely hyped, UGC was underused by the longest-running brands in our dataset.

This doesn’t mean UGC is ineffective, quite the opposite. But it suggests many brands either:

- Overuse short-form or shallow UGC that burns out quickly

- Rely on unstructured or off-brand creator content

- Or still haven’t dialed in a consistent UGC strategy

Structured, longer-form UGC with strong scripts performed better, but it’s still an untapped growth lever in this space.

8. Meta’s New Policy Enforcement is Silently Killing Ad Accounts

A non-data but critical insight: Since April, Meta has been aggressively enforcing its Health & Wellness Policy, flagging supplement ads for things like:

- Mentioning medical outcomes or diagnoses

- Using prescription-style language

- Promoting intimate or hormonal health solutions

Once flagged, brands experience sudden performance drops, conversion tracking outages, and sometimes ad account restrictions, often with no clear explanation.

This makes compliance, language audits, and backup tracking systems essential for any supplement brand scaling on Meta in 2025.

Final Thoughts: Data-Driven Supplement Marketing Is No Longer Optional

The supplement marketing is maturing.

The days of “launch and hope” are over.

Emerging supplement marketing trends show a clear shift toward precision, performance visibility, and creative alignment across every step of the funnel. The data proves it: simplicity often beats over-produced content, and consistency drives more results than flashy one-offs.

If you’re a supplement brand looking to scale, the biggest takeaway is this:

Find your winners. Double down. Eliminate what doesn’t last. And do it all backed by real data, not guesswork.